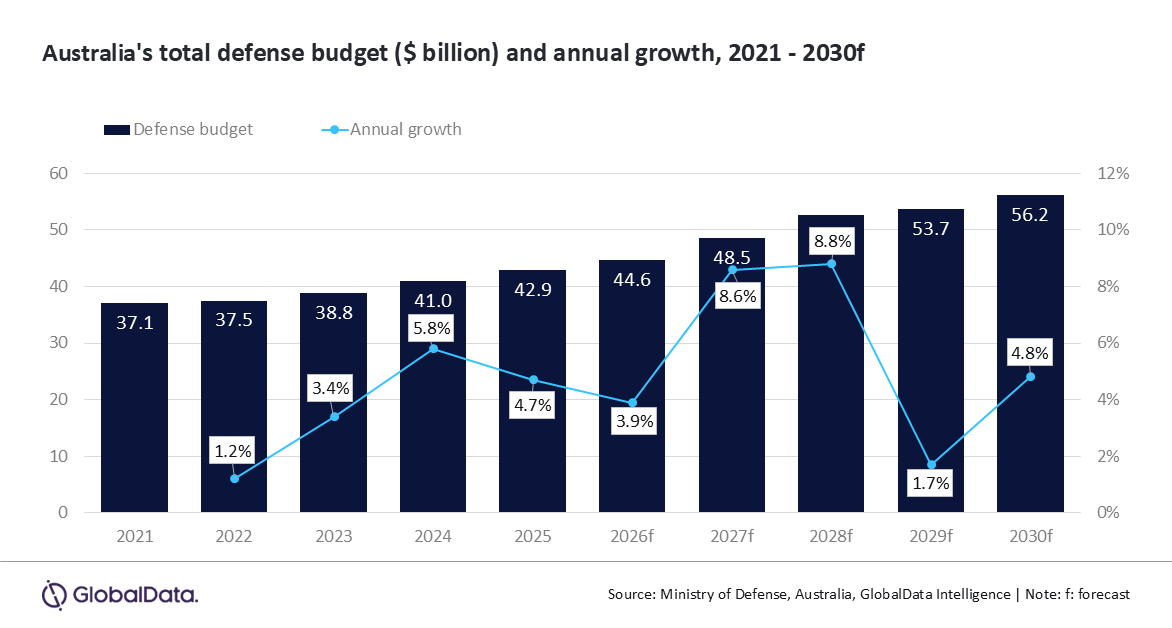

Amid escalating tensions in the Indo-Pacific, shifting geopolitical fault lines and growing strategic competition, Australia is accelerating efforts to modernise its military. Against this backdrop, Australia’s defence budget is set to increase at a compound annual growth rate (CAGR) of 5.9% from $44.6 billion in 2026 to $56.2 billion in 2030, driven in large part by the transformative trilateral security alliance named AUKUS, between Australia, the UK and the US, forecasts GlobalData, a data and analytics company.

Amid escalating tensions in the Indo-Pacific, shifting geopolitical fault lines and growing strategic competition, Australia is accelerating efforts to modernise its military. Against this backdrop, Australia’s defence budget is set to increase at a compound annual growth rate (CAGR) of 5.9% from $44.6 billion in 2026 to $56.2 billion in 2030, driven in large part by the transformative trilateral security alliance named AUKUS, between Australia, the UK and the US, forecasts GlobalData, a data and analytics company.

GlobalData’s latest report, “Australia Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2025–30,” highlights the country’s defence acquisition and R&D budget cumulatively grew from $10.2 billion in 2021 to $11.4 billion in 2025, underscoring investment in advanced capabilities. Operations and maintenance is expected to increase from $14 billion in 2026 to $17.4 billion in 2030 (5.6% CAGR), reflecting the growing demand in sustainment, infrastructure and equipment maintenance over the forecast period.

Akash Pratim Debbarma, Aerospace & Defense Analyst at GlobalData, comments: “AUKUS is a defining driver of Australia’s defence trajectory. The partnership not only enables the acquisition of nuclear-powered attack submarines (SSN) but also catalyses broader modernisation across maritime, air and land domains. The SSN program, built in close cooperation with the UK and US under AUKUS, will require significant new infrastructure and sustainment investment.

Government allocations for SSN program are set to increase from $2.4 billion in 2025 to $5 billion in 2030, reflecting the intensive support requirements of the future SSN fleet. These programs, from SSNs and the Hunter-class frigates to F-35 sustainment, MQ-4C Triton UAVs and next-generation land vehicles, are reshaping Australia’s force posture and industrial base.

Debbarma adds: “Rising US–China rivalry and China’s military assertiveness are contributing to a complex security landscape in the Indo-Pacific. Australia’s reliance on alliances like AUKUS, combined trade dependencies with China and climate-related domestic vulnerabilities, are shaping its defence priorities and risk assessments.”

The recent altercations with China at sea and in the air have highlighted the growing tensions and have amplified calls within Australian polity for enhanced maritime surveillance, patrol and deterrent capabilities. At the same time, supply-chain resilience is receiving attention: both Australia and partners are pursuing expanded processing capacity for strategic minerals and defence-related supply chains outside China, requiring substantial investment and active government participation.

Debbarma concludes: “Australia’s 2023 Defence Strategic Review and procurement pipeline demonstrate a clear commitment to sustained capability uplift and industrial participation. By investing across maritime, air and land domains and deepening interoperability with allies, Australia aims to strengthen deterrence, ensure regional stability and safeguard national interests in an increasingly contested Indo-Pacific.”